29 Jul No US federal taxes for the entity owned by Indian National.

Is the US really a TAX HAVEN?

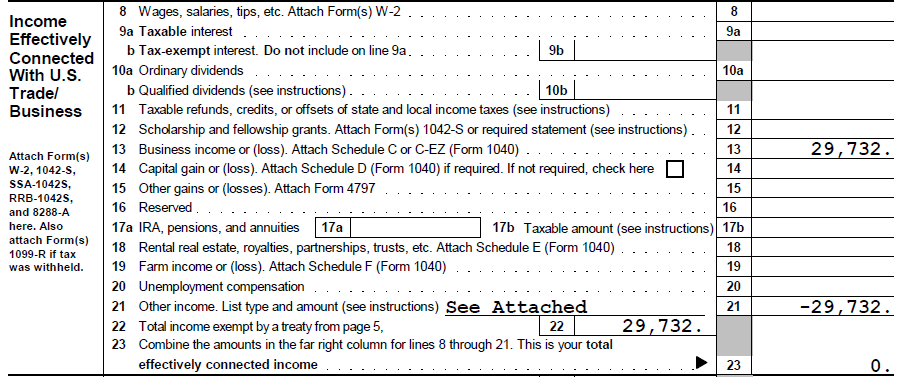

Here at Shipcrow, we help Indian businesses and individuals file their US companies with remote operations to pay no US federal taxes. There is a tax treaty in place which could be claimed to allow your profits from US business to be taxed only in India.

A US business paying your company more than $600 in one calendar year may report the transaction to the IRS. Your US business paying to other business might also have to report the transaction to the IRS. The reporting has to be done right to avoid heavy fines which do start at a minimum of $10,000. It is very important that the filing is done for the reporting purposes.

We provide company registrations, leased office address, bank accounts, ITIN, payment gateways, CPA guidance, warehouse fulfillment, tax filing, company compliance, US sales tax registration and filing, Indian RBI compliance and much more.

Indian Businesses who enjoy the US tax free benefits with our help are from industries like IT, ITES, Travel & Tourism, Medical, Drop-ship, E-commerce.

We will be more than happy to assist you with any queries regarding setup in US and compliance in India. Our CPA’s and tax lawyer will work for your business needs both in INDIA and USA. You may also schedule a meeting with our India office by contacting the whats-app number: +91-8899860200 (M-S 10-am to 7-pm).

Sorry, the comment form is closed at this time.