Posted at 07:13h

in

BLOG

by admin

Is the US really a TAX HAVEN?

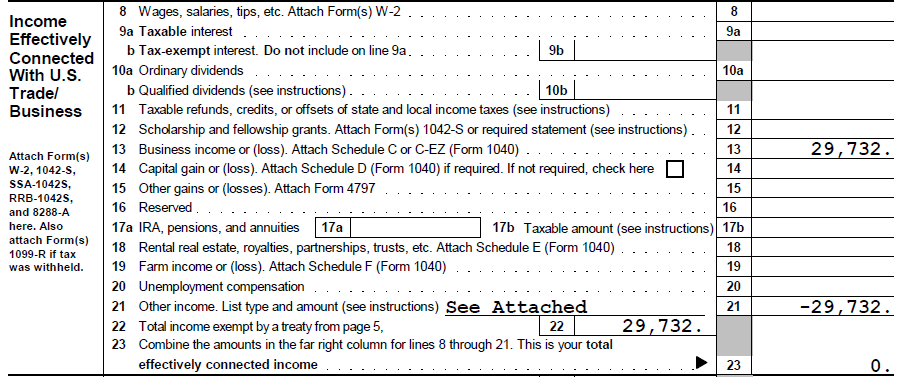

Here at Shipcrow, we help Indian businesses and individuals file their US companies with remote operations to pay no US federal taxes. There is a tax treaty in place which could be claimed to allow...

Posted at 14:11h

in

BLOG

by admin

Most of the marketplaces in developed countries (as in the USA) would require the seller to have a presence in the country. You would need to register a US company and get a USD account to register on these marketplaces, both of which could be...

Posted at 16:20h

in

BLOG

by admin

A foreign-owned USA company can serve as a tax haven in the US for many non-US residents. The internal revenue code IRC Sec -6038A states, a domestic corporation which is 25% foreign owned is subjected to report to the IRS informational return annually.

For Example - An Indian or Chinese...

Posted at 18:36h

in

BLOG

by admin

It is no secret that entrepreneurs from around the world are on the rise. Whether you have launched a valuable service or operate a tech startup you should protect yourself from the start. You can not claim something is your property unless you own it....

Posted at 20:06h

in

BLOG

by admin

Have you just registered a company in any one US State?

Business license compliance is an important aspect of owning a company, but it does not have to be stressful or tedious. The following are the circumstances in which the requirement of your existing business registration...

Posted at 16:32h

in

BLOG

by admin

Our story:

We are a tourism business. Our base operations are in India and we were looking to set up our operations in the USA. We came across Shipcrow last year through a social website Quora and it guided us in the right direction.

We have been in...

Posted at 14:57h

in

BLOG

by admin

Are you a foreign national planning to expand your business to the USA?

You might have few questions about doing business in the USA, like the ones below.

Do I need a US visa to do business in the USA?

How to get my business established in the USA while...